Corporate governance policy/basic concept

Regarding corporate governance

basic way of thinking

J-OIL MILLS Group has established a business execution system and monitoring/ Supervise system in accordance with the Companies Act in order to meet society's expectations and fulfill its responsibility to society by providing economic and environmental value.

The Group reliably operates an internal control system built in accordance with the Companies Act and the Financial Instruments and Exchange Act, conducts Internal audit, and improves the effectiveness of the system by correcting deficiencies.

In order to achieve honest and highly transparent management that earns the trust of stakeholders, we are Strengthen Corporate Governance and enhancing internal controls with the aim of improving its effectiveness.

The latest Corporate Governance Report can be viewed below. (Updated July 2025)

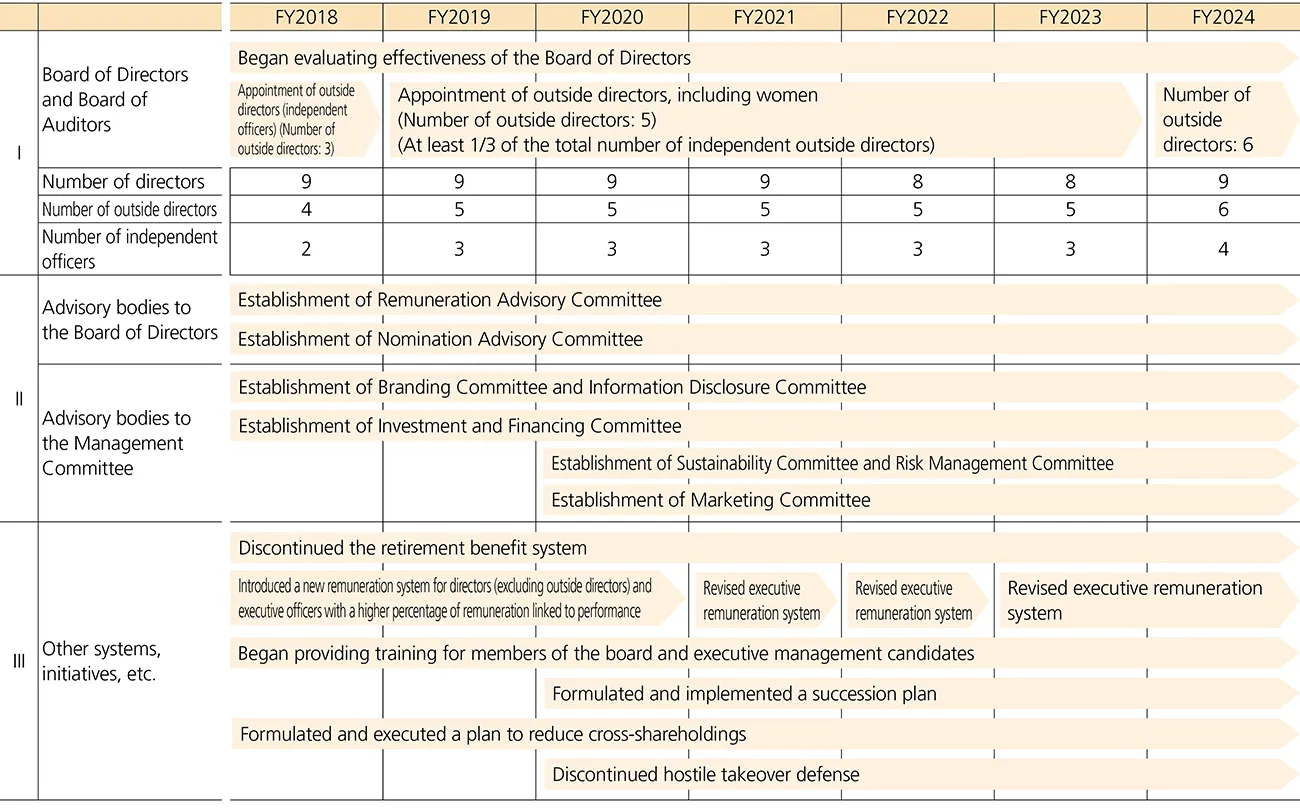

History of initiatives to improve governance

Basic policy of capital policy

We will implement appropriate capital policies based on an understanding of capital costs in order to increase corporate value. In addition, we will allocate operating cash flow and external funding in a well-balanced manner to growth investments including M&A, capital investments, and shareholder returns.

By setting target values for ROE and ROIC as important management indicators, we aim to build an optimal capital structure that matches our business structure and to achieve a structure that stably exceeds the cost of capital.

Regarding dividends, we will allocate the cash flow generated through earnings expansion to investments for growth, and aim to stably and continuously strengthen returns to shareholders by setting a consolidated dividend payout ratio of 40%.

Presence of takeover defense

It was abolished at the conclusion of the regular The General Meeting of Stockholders for the fiscal FY2020.

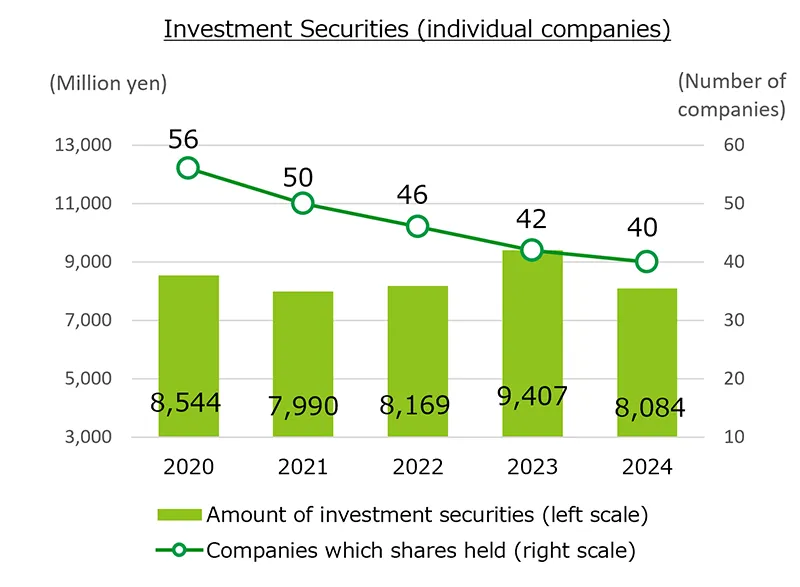

Policy regarding cross-shareholdings

The Group has a policy of holding the minimum amount of shares deemed to contribute to the enhancement of its corporate value in the medium to long term, and gradually reducing such holdings.

We will hold the minimum amount of shares deemed to contribute to the improvement of our corporate value. When deciding whether to hold shares, we will confirm the significance of holding them individually from various perspectives, such as the economic rationale of holding them and the likelihood of improving profitability. Shares that are deemed to be meaningful to hold will be verified regularly by Board of Directors. For shares whose appropriateness for holding cannot be confirmed, we will proceed with selling them only after obtaining the full understanding of the business partner company.

Furthermore, even if the Company recognizes the significance of holding certain shares, the Company may sell them in accordance with its basic policy for reducing cross-shareholdings, taking into consideration the market environment, management and financial strategies, etc.

Criteria for exercising voting rights for cross-shareholdings

Based on the premise that it will contribute to improving our corporate value, we will comprehensively judge whether the investment will contribute to the sustainable growth and medium- to long-term corporate value of the investee company, based on the following criteria.

- Quantitative evaluation: safety, profitability, performance, dividend payout ratio, impairment risk due to stock price decline, etc.

- Qualitative evaluation: Important subsequent events, notes regarding going concern assumptions, unusual opinions from Accounting audit, serious illegal acts or anti-social acts, etc.

Status for FY2024

We sold three of our cross-shareholdings (sales amount: 1046 million yen), and one of them in their entirely)

Changes in balance sheet amount of securities (submitting company) and number of securities

Other policies etc.

Please see below for other regulations and policies of our Group.

https://www.j-oil.com/sustainability/esg/policy.html