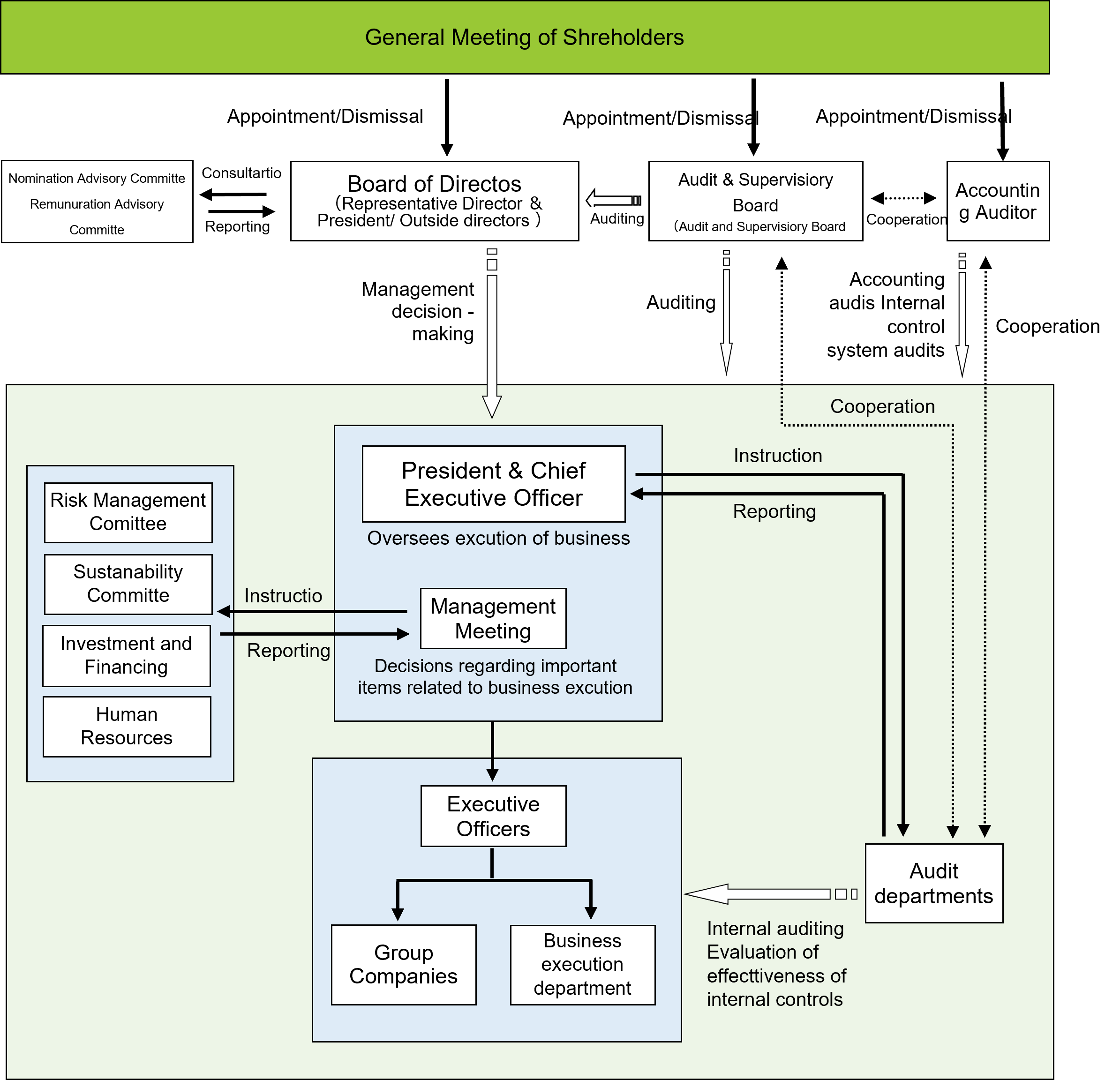

Governance system

- Governance system diagram

- Board of directors

- Evaluation of the effectiveness of board of directors

- Audit & supervisory committee

- Internal audit

- Nominating advisory committee / Compensation advisory committee

- Composition and attendance status of board of directors, audit & supervisory committee, and each committee

- Executive committee / Other committees

Governance system diagram

Board of directors

The Board of Directors consists of eight members: two full-time in-house Member of the Board, one part-time in-house Member of the Board, and five part-time Member of the Board(Outside Director) (three of whom are Independent Outside Director). As a general rule, extraordinary Board of Directors meetings are held once a month and as necessary to determine matters stipulated by laws and regulations or the Articles of Incorporation, management policies, and other important matters related to management, and to ensure the Supervise execution of Member of the Board duties.

*For the independence standards of the Company's Member of the Board(Outside Director) and Outside Audit and Supervisory Board Member, please see "2.1. [Independent Outside Director] Other Matters Related to Independent Outside Director" in the Corporate Governance Report.

Corporate Governance Report (620KB) (Updated July 2025)

Main discussion topics for fiscal 2024

| Category | Agenda/Theme | Overview |

|---|---|---|

| Growth Strategy | Oils and Fats Business strategy |

|

| Foreign operation |

|

|

| Research and development strategy |

|

|

| New business |

|

|

| structural reform | Business portfolio restructuring |

|

| Innovation through DX |

|

|

| Strengthen our management foundation | Sixth Medium-Term Business Plan |

|

| Sustainability |

|

|

| Risk management |

|

|

| Internal audit |

|

|

| Shareholder composition |

|

|

| Governance |

|

|

| Human Capital Management |

|

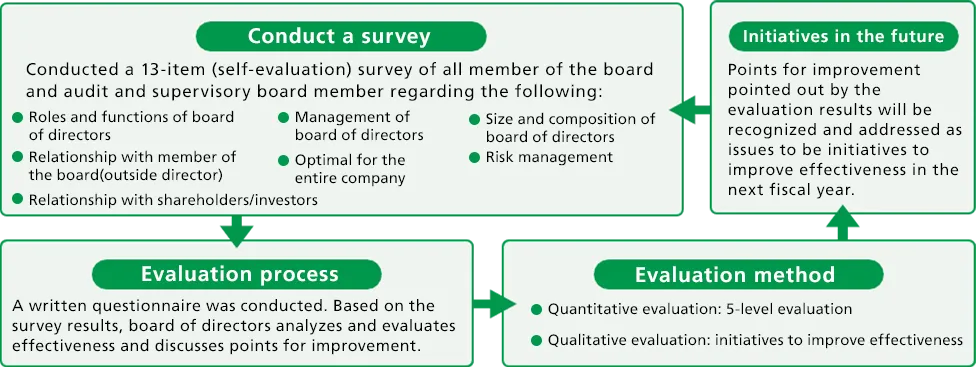

Evaluation of the effectiveness of board of directors

The Company conducts evaluations of the effectiveness of Board of Directors with the aim of further increasing the effectiveness of Board of Directors.

Implementation overview

Results of effectiveness assessment in FY2024

According to the results of the questionnaire, the effectiveness of Board of Directors was generally at a certain level, but there were several items that showed improvement as a result of proceeding with initiatives, focusing on issues identified by the previous year's evaluation. At the same time, on the other hand, points that need to be improved in the future were also pointed out and are recognized as initiatives issues for improvement of effectiveness in FY2024.

Based on issues identified in the FY2023 survey, we will be initiatives the following steps in FY2024.

| Attempt | Results |

|---|---|

| Further advance agenda setting for discussions on management issues to achieve sustainable growth | The meeting formulated an annual agenda in line with growth strategies, structural reforms, and strengthening of management foundations that will contribute to the company's sustainable growth, and also discussed updates to the medium- to long-term vision and Medium-Term Business Plan. |

| Strengthening the roles and functions of Board of Directors | To improve the understanding of our outside directors about our business, we held study sessions on our products and technologies and toured our production sites. In addition, to improve the "information asymmetry" between our inside Member of the Board and Member of the Board(Outside Director), we worked to improve the explanations given before Board of Directors meetings and ensure opportunities for information sharing by participating in executive events, including Executive Officer off-site meetings. |

Key points for improving future effectiveness evaluations

We will continue to promote initiatives for fiscal 2024, and based on discussions at Board of Directors, we have decided to further promote the following initiatives.

| initiatives issues | Points for improvement |

|---|---|

| Clarifying the roles and functions of Board of Directors | The Committee will promote discussions on the direction Board of Directors should take (organizational design and Member of the Board composition) with the aim of contributing to the sustainable growth of the Company. |

| Enhancement of executive discussions and optimization of Board of Directors agenda | We will enhance discussions among executives regarding the business portfolio and allocation of management resources, and aim to optimize agenda setting at Board of Directors meetings. |

Audit & supervisory committee

Audit & Supervisory Committee is made up of four members, including one Audit and Supervisory Board Member(Standing) and three Outside Audit and Supervisory Board Member (Independent Outside Director Audit & Supervisory Committee, and meets once a month in principle and whenever necessary. Audit & Supervisory Committee is required to include at least one member with a considerable degree of knowledge of finance and accounting.

Each Audit and Supervisory Board Member audits the legality and appropriateness of business execution in accordance with the audit policy, audit plan, and division of audit duties established by Audit & Supervisory Committee, and reports to Board of Directors. In addition, liaison meetings are held to strengthen cooperation with Member of the Board(Outside Director), and information is shared regarding business conditions, governance, etc.

*For the independence standards of the Company's Member of the Board(Outside Director) and Outside Audit and Supervisory Board Member, please see "2.1. [Independent Outside Director] Other Matters Related to Independent Outside Director" in the Corporate Governance Report.

Corporate Governance Report (620KB) (Updated July 2025)

Priority audit items

| Priority audit items | Activities |

|---|---|

| Verifying the responsibilities of Member of the Board and the effectiveness of Board of Directors |

|

| Strengthening internal control system verification |

|

| Verification of internal culture reform initiatives |

|

| Verification of the governance status of Group companies |

|

Internal audit

The Internal Audit Department checks and provides guidance mainly through operational audits. The Audit Department audits the overall internal control of executive departments in accordance with the audit plan approved by the Board of Directors, and periodically reports the status of audit implementation to the management.

Nominating advisory committee / Compensation advisory committee

J-OIL MILLS in order to increase the independence and objectivity of the functions of Board of Directors and to strengthen accountability, the Company has established "Nominating Advisory Committee" and "Compensation Advisory Committee" with Member of the Board(Outside Director) as chairpersons.

The independence of the committee is ensured by having the chairman and a majority of the committee members be independent Member of the Board(Outside Director).

Nominated Consult committee

- Composition: 4 Member of the Board(Outside Director) and 1 internal Member of the Board

- Functions/Role: Deliberates on the nomination, appointment and dismissal of Member of the Board and Executive Officer, and Report to Board of Directors.

- In fiscal year 2024, the committee convened six times, primarily to deliberate on matters such as proposals for the appointment and dismissal of directors and executive officers, the committee’s activity plan for FY2024, the CEO succession plan, succession planning for key management personnel, and the skills matrix for directors and other executives.

Compensation Advisory Committee

- Composition: 4 Member of the Board(Outside Director), 1 internal Member of the Board, and 1 internal Audit and Supervisory Board Member

- Functions/Role: Deliberates on the need to revise executive remuneration system and evaluation system for Member of the Board and Executive Officer, and the appropriateness of compensation, and Report to Board of Directors.

- In fiscal year 2024, the committee convened six times, primarily to deliberate on the compensation system (including short-term and long-term incentives), as well as the committee’s activity plan for FY2024.

Composition and attendance status of board of directors, audit & supervisory committee, and each committee

Composition and attendance in 2024

| full name | Position *1 | attribute | Board of directors | Audit & supervisory committee | Nominating Advisory Committee | Compensation Advisory Committee | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| composition | Attendance/Number of events | Attendance rate | composition | Attendance/Number of events | Attendance rate | composition | Attendance/Number of events | Attendance rate | composition | Attendance/Number of events | Attendance rate | |||

| Tatsuya Sato | Member of the Board Executive Officer, President |

● | 16/16 | 100% | ○ | 6/6 | 100% | ○ | 6/6 | 100% | ||||

| Takeshi Kamigochi | Member of the Board, Executive Officer, Senior Vice President |

○ | 16/16 | 100% | ||||||||||

| Eizo Matsumoto | Member of the Board, Executive Officer, Senior Vice President |

○ | 16/16 | 100% | ||||||||||

| Tatsuya Sasaki | Member of the Board, Outside Director | ○ | 16/16 | 100% | ||||||||||

| Osamu Watanabe *2 | Member of the Board, Outside Director | ○ | 4/4 | 100% | ||||||||||

| Yoshiri Itaru *3 | Member of the Board, Outside Director | ○ | 12/12 | 100% | ||||||||||

| Yugo Ishida | Member of the Board, Outside Director | independence | ○ | 16/16 | 100% | ○ | 6/6 | 100% | ● | 6/6 | 100% | |||

| Tsuyoshi Kameoka | Member of the Board, Outside Director | independence | ○ | 16/16 | 100% | ● | 6/6 | 100% | ○ | 6/6 | 100% | |||

| Hiroko Koide *2 | Member of the Board, Outside Director | independence | ○ | 4/4 | 100% | ○ | 2/2 | 100% | ○ | 1/1 | 100% | |||

| Akiko Ikeda *3 | Member of the Board, Outside Director | independence | ○ | 10/12 | 83% | ○ | 4/4 | 100% | ○ | 5/5 | 100% | |||

| Maki Mifuyu *3 | Member of the Board, Outside Director | independence | ○ | 12/12 | 100% | ○ | 4/4 | 100% | ○ | 5/5 | 100% | |||

| Shunichi Komatsu *2 | Audit and Supervisory Board Member(Standing) | ○ | 4/4 | 100% | ● | 8/8 | 100% | ○ | 1/1 | 100% | ||||

| Masami Kashiwakura *3 | Audit and Supervisory Board Member(Standing) | ○ | 12/12 | 100% | ● | 16/16 | 100% | ○ | 5/5 | 100% | ||||

| Akira Nozaki | Audit and Supervisory Board Member | ○ | 15/16 | 94% | ○ | 24/24 | 100% | |||||||

| Hideo Mizutani | Outside Audit and Supervisory Board Member | independence | ○ | 15/16 | 94% | ○ | 24/24 | 100% | ||||||

| Akira Muto *2 | Outside Audit and Supervisory Board Member | independence | ○ | 4/4 | 100% | ○ | 8/8 | 100% | ||||||

| Masaki Ueno *3 | Outside Audit and Supervisory Board Member | independence | ○ | 12/12 | 100% | ○ | 16/16 | 100% | ||||||

●…Chairman or chairperson, 〇…Committee or member

*1 Titles and positions are as of March 31, 2025, the end of the fiscal year. For individuals who resigned during the fiscal year, their titles are listed as of the time of resignation.

*2 Mr. Osamu Watabe, Ms. Hiroko Koide, Mr. Shunichi Komatsu, and Mr. Akira Muto retired at the conclusion of the 22nd Annual General Meeting of Shareholders held on June 24, 2024. Therefore, their attendance records are provided up to the time of their retirement.

*3 Mr. Kaku Yoshisato, Ms. Akiko Ikeda, Ms. Mifuyu Maki, Mr. Masami Kashiwakura, and Mr. Masaki Ueno were appointed at the conclusion of the 22nd Annual General Meeting of Shareholders held on June 24, 2024. Therefore, their attendance records are provided from the time of their appointment onward.

Executive committee / Other committees

Consult body to Executive Committee

- Risk Management Committee

Under the umbrella of Compliance Subcommittee and Risk Management Subcommittee, the purpose is to respond comprehensively and promptly to potential risks that may affect management, crises (manifested risks) such as noncompliance, and crises (major crises), and to prevent and reduce the impact of such risks, and to raise employee compliance awareness and The company is working on addressing violations, assuming and preventing risks, and responding to crises.

For details of the risk management system, please see below.

Risk Management System - Sustainability Committee

The purpose of this committee is to incorporate the idea of sustainability, which is linked to our corporate philosophy, into our business activities and to hold necessary discussions. We position climate change countermeasures throughout the supply chain as a top priority, and we work to resolve issues by sharing sustainability and reducing environmental impact across the entire company issues from procurement to production, logistics and sales.

Please see below for details on our sustainability promotion structure.

Sustainability Promotion Structure - Human Resources Committie

In order to sustainably enhance corporate value, we believe that initiatives focused on "human capital," which serves as the foundation of corporate activities, are essential. Based on this belief, we have evolved and dissolved the "Human Capital Subcommittee," which previously operated under the Sustainability Committee, and established a new "Human Resources Committee" as of April 2025. This committee will work to develop systems and workplace environments that enable employees to grow more than ever before, while formulating human resource strategies aligned with management and business strategies to strengthen implementation. - Investment and Financing Committee

The purpose of the committee is to consider from various angles the implementation and follow-up of investments, loans, and corporate alliances, as well as the identification and revitalization of unprofitable businesses, in order to contribute to the deliberations of Executive Committee. The committee considers the details, issues, necessity, risks, financial plans, management structures for PMI, etc., and priorities from a company-wide perspective, taking into account the consistency of each project with the corporate philosophy and management plans, compliance with investment plans and domestic and international laws and regulations, and ensuring safety, the environment, and quality.

Other committees

- Information Disclosure Committee

As an organization responsible for strengthening strategic information dissemination and making company-wide information disclosure decisions, we promote timely, appropriate, and fair information disclosure. - Branding Committee

We are working to spread the brand both internally and externally through the formulation of brand strategies aimed at improving the brand power of Communication brand JOYL, and the formulation and implementation of brand reinforcement measures.