Message from the CFO

We will continue to meet the expectations of society, the market, and all stakeholders as we pursue further growth and enhanced corporate value.

CFO Mission and FY2024 Overview

Takayuki Uchida

In addition to management by business division, we are advancing a matrix-style management structure that integrates a functional perspective. This enables management to exercise leadership from the standpoint of overall company optimization, working together to address materiality.

As CFO, I am committed to advancing initiatives under the three pillars of our Sixth Medium-Term Business Plan—growth strategy, structural reform, and financial strategy—in a well-balanced manner. My goal is not only to achieve the numerical targets but also to steadily enhance corporate value over the medium to long term.

In FY2024, operating profit and other profit stages exceeded full-year forecasts, and we achieved record-high profit levels. While continuing to pursue structural reforms, in our existing businesses we strengthened profitability by securing sufficient spreads through appropriate sales pricing, thereby responding to increased costs across the supply chain, including fluctuations in raw material prices and higher distribution, materials, and energy costs in Japan. As a result, key indicators such as return on invested capital (ROIC) and earnings per share (EPS) are progressing steadily toward the targets in the Sixth Medium-Term Business Plan.

On the other hand, I recognize the fact that our price-tobook ratio (PBR) has remained below 1.0 as a serious management issue. Contributing factors include the high dependence on the domestic oils and fats business, where volatility in raw material prices directly impacts performance, and the fact that return on equity (ROE) has not consistently exceeded the weighted average cost of capital. More fundamentally, however, I believe the issue lies in our inability to sufficiently convey to capital markets the management strategies and growth story that will enable us to raise corporate value over the medium to long term.

PBR is one indicator that reflects the capital market’s assessment of our company’s growth potential and future prospects. To clearly present our medium- to long-term growth story, in addition to steadily achieving the strategies and targets set forth in the Sixth Medium-Term Business Plan, we will formulate and implement comprehensive management measures such as maximizing capital efficiency, advancing our business portfolio, and pursuing a cash allocation strategy that balances growth investment with financial soundness.

Going forward, the management team will continue to work together to ensure that our direction is clearly understood by all stakeholders through consistent and persuasive communication.

Capital Policy and Current-Term Initiatives toward Growth

Looking back on cash allocation up to FY2024, operating cash flow continued to perform strongly for the second consecutive year. In addition, improvements in asset efficiency, such as inventory reduction through value chain optimization and the sale of cross-shareholdings, produced results that exceeded the progress expected under the Medium-Term Business Plan. In particular, for improving the cash conversion cycle (CCC) aimed at enhancing working capital efficiency, we have identified a variety of measures and are developing frameworks that allow rapid responses according to circumstances.

In terms of external financing, our fundamental policy is to maintain sound financial management, with the preservation of our credit rating as a key premise. In FY2024, we made planned repayments of borrowings, reduced interest-bearing debt, and brought the D/E ratio to a healthy level of 0.26 times, thereby securing financial flexibility for future growth investments. Going forward, we will review our approach to cash allocation, using the cash generated and our strong financial foundation to strengthen competitiveness in existing businesses, invest in growth—including new businesses and M&A—and enhance shareholder returns. In growth investment in particular, agile responses are essential, and we are preparing multiple scenarios for capital policy, including financing methods.

Regarding business investments, our focus is on projects that can create synergies with existing businesses or supplement management resources to achieve our strategies. In FY2024, after careful consideration, no such projects were executed. We will continue to carefully assess opportunities that contribute to realizing our vision of “Joy for Life—Bringing Joy to the Future by Food” and proceed steadily.

In existing businesses, we are examining dX measures to deepen our solution proposal capabilities, the driving force of our strength in “Oishisa Design (creating deliciousness),” by converting customer issue-solving know-how and scientific evidence into knowledge and building and utilizing databases. Centered on the CTO-led “dX Promotion Project”, we will systematize this as organizational knowledge, thereby contributing to the realization of “advancing the business portfolio,” a priority measure of the Sixth Medium-Term Business Plan.

Furthermore, in addition to deepening solutions and expanding into new markets and customers, we will accelerate overseas expansion in the ASEAN region and North America by leveraging our strengths in “Oishisa Design,” thus advancing another key issue: “promotion of overseas business.”

With regard to capital investment, until now we have primarily updated facilities within the scope of depreciation expenses. However, recent surges in material and labor costs have made the cost of renewing aging facilities increasingly significant. To fulfill our social responsibility of delivering safe and reliable products on a stable basis, capital investment requires even greater planning from a medium- to long-term perspective. Accordingly, when approving investment budgets, I make every effort to visit production sites whenever possible, to accurately understand actual conditions on the ground and make optimal investment decisions.

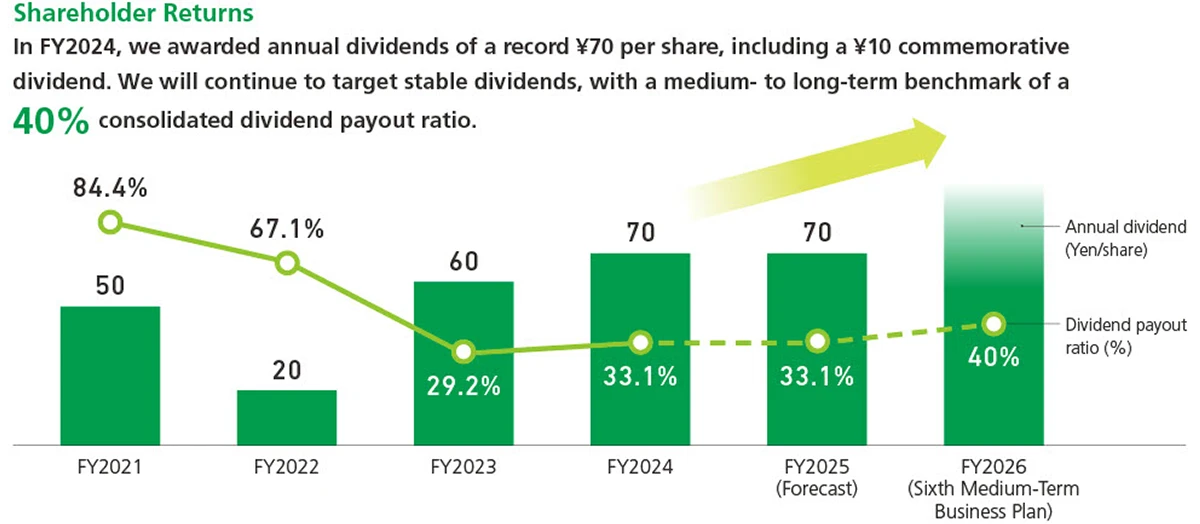

On shareholder returns, our basic policy is to provide stable and continuous dividends, with a medium- to long-term target of a consolidated dividend payout ratio of around 40%. For FY2024, the annual dividend per share was ¥70, the highest since our listing, including a ¥10 commemorative dividend marking the 20th anniversary of J-Oil Mills. Looking ahead, we will continue to target stable business growth and, by enhancing corporate value over the medium to long term, aim for a consolidated dividend payout ratio of 40% while further enhancing returns to shareholders.

Strategic Investment for Our Sustainable Growth

Bringing joy for people, society, and the environment through “good taste, health, and low burden,” we aim to contribute to solving social issues by creating value that meets societal expectations. We believe that creating and delivering social value while enhancing corporate value is a fundamental responsibility of a company. To this end, in addition to generating synergies through the integration of our R&D sites and promoting dX, we view investments in non-financial domains as important opportunities for enhancing corporate value. By quantifying their financial impact, we prioritize investment targets.

Going forward, we will clarify our basic policy and overall framework for these investments, including nonfinancial domains, and further strengthen the allocation of resources to priority areas directly linked to enhancing corporate value.

To Our Stakeholders

We recognize that further growth and enhancement of corporate value require raising the bar across all aspects of our business—scale, market capitalization, and profitability. To reliably meet the expectations of society, the market, and stakeholders, it is essential that we communicate our potential and growth story more clearly and more forcefully.

As CFO, I consider it vital to balance the implementation of growth strategies with the maintenance of financial soundness, in order to improve capital efficiency and achieve a PBR of 1.0 times at the earliest possible date. Looking to medium- to long-term corporate value enhancement, we will introduce a companywide KPI map to visualize the progress of each initiative, enabling us to press the accelerator where necessary in a timely manner.

In addition, supporting the execution of initiatives that contribute to growth is also a key responsibility of the CFO. As a strategic partner in management, I will continue to focus on developing human resources so that our organization can evolve into one capable of proactive action—reading the facts and signs behind the numbers and managing risks appropriately.

I sincerely ask for your continued understanding and support.