Response to TCFD recommendations

Overview

In November 2020, our company expressed support for the recommendations made by the TCFD (Task Force on Climate-related Financial Disclosures) and is participating in the TCFD consortium. We have established a cross-company TCFD subcommittee within Sustainability Committee to promote information disclosure in accordance with the disclosure items recommended by the TCFD recommendations.

Governance

For details on governance related to TCFD, please refer to the "Sustainability Promotion System" page.

Linking executive compensation and ESG indicators

Starting in fiscal 2022, our company has incorporated ESG indicators into the individual performance targets of executives. One of the ESG indicators we incorporate is climate change response, such as reducing CO2 emissions. By introducing incentives that link executive compensation and ESG indicators, we will strengthen executives' initiatives of climate change countermeasures and promote ESG Management.

Strategy

Prerequisites

The Group regards climate change as a very important management risk in terms of business continuity, and is analyzing risks and opportunities for below 2°C and 4°C scenarios.* In addition to climate change, we also regard the worsening of typhoon damage due to global warming as a risk factor.

*The below 2°C and 4°C scenarios are projections of how much the average temperature will rise from before the Industrial Revolution to the end of the 21st century, as presented in the Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC), which provides scientific evidence for countermeasures to global warming and is influential in international negotiations. The scenario with the lowest temperature rise (SSP1-1.9 scenario) predicts a rise of approximately 1.4°C, while the scenario with the highest temperature rise (SSP5-8.5 scenario) predicts a rise of approximately 4.4°C.

●Less than 2℃ scenario

With the introduction of strict environmental regulations and high carbon taxes, the world will achieve carbon neutrality in 2050. In the agricultural sector, CO2 While achieving zero emissions, procurement costs are increasing due to expanding demand for biofuels and environmental regulations. As consumers become more environmentally conscious, demand for plant-based foods will expand.

The temperature in Japan has risen by approximately 1.4℃ compared to the end of the 20th century. Although the frequency and intensity of natural disasters (typhoons and floods) in Japan will increase, they will not worsen to the level assumed in the 4℃ scenario.

●4℃ scenario

Although progress is being made in reducing carbon emissions, carbon neutrality in 2050 will not be achieved. Natural disasters are becoming more severe and frequent, and the frequency of flood damage at suppliers and our own production bases is increasing. Due to rising temperatures, the yield and quality of agricultural crops are becoming worse.

Temperatures in Japan are expected to rise by approximately 2.3 degrees Celsius by around 2050 compared to the end of the 20th century. Additionally, as the frequency of typhoons increases, their intensity also increases. Flood frequency will be approximately 2 to 4 times more frequent than at the end of the 20th century.

| Target period | From now to 2050 |

|---|---|

| Target range | All businesses of J-Oil Mills Group |

Major: Potential impact on business performance (over 10 billion yen)

Medium: Potentially a significant impact on business performance (1 billion yen to less than 10 billion yen)

Small: Small impact on business performance (less than 1 billion yen)

High: Within 1 year Medium: Within 5 years Low: More than 5 years

Scenario: 2℃/1.5℃ Item: Transition risk

| Minutes Category |

Main risks | Risk Description | Impact | Urgent Sudden Every time |

Existing initiatives | Response direction (goal) |

|---|---|---|---|---|---|---|

policy |

|

|

2.4 billion yen/year (※1) | During ~ |

|

|

|

During ~ | During ~ | ||||

market |

|

|

During ~ | During ~ |

|

|

reputation |

|

|

During ~ | During ~ |

|

|

Scenario: 4°C Item: Physical risk

| Minutes Category |

Main risks | Risk Description | Impact | Urgent Sudden Every time |

Existing initiatives | Response direction (goal) |

|---|---|---|---|---|---|---|

acute |

|

|

400 million yen/year (※4) | High |

|

|

|

During ~ |

|

||||

Chronic |

|

|

Big | During ~ |

|

|

*1 IEA: International Energy Agency's forecast of emissions trading prices for developed countries in the NZE scenario (Net Zero Emissions by 2050 scenario) (2030): Calculated by multiplying 140 US$/t by the amount of emissions in fiscal 2024 and the average exchange rate for that period. The amount of risk decreased slightly from fiscal 2023 to fiscal 2024.

*2 PBF: Plant-based food

*3 Damage amounts were calculated based on risk assessments using Aqueduct, a global water risk assessment tool published by the World Resources Institute (WRI), and converted to annual damage amounts.

*4 BCP (Business Continuity Planning): Business continuity plan

*5 Main ingredients: soybean, canola

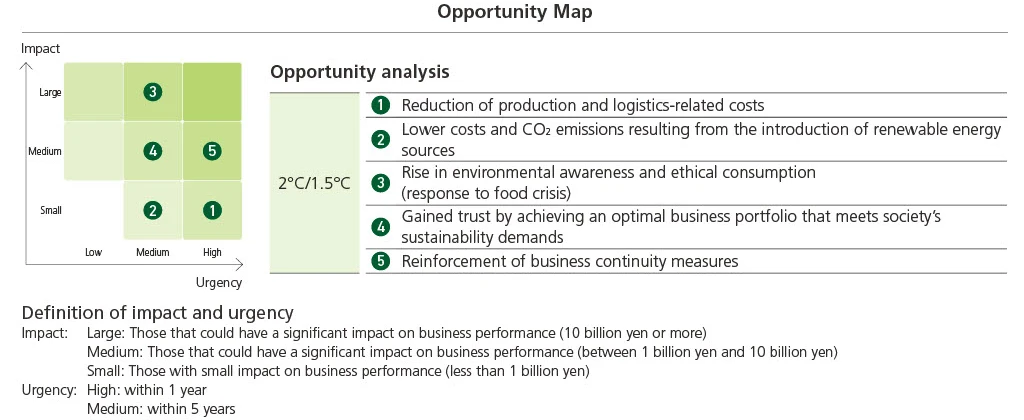

Scenario: 2°C/1.5°C

| Minutes Category |

Main Opportunities | Opportunity Description | Shadow sound Every time |

Urgent Sudden Every time |

Existing initiatives | Response direction (goal) |

|---|---|---|---|---|---|---|

Resource Efficiency |

|

|

small | High |

|

|

Energy Source |

|

|

small | During ~ |

|

|

market |

|

|

Big | During ~ |

|

|

Resilience |

|

|

During ~ | During ~ |

|

|

|

|

During ~ | High |

|

|

*6 SAF: Sustainable Aviation Fuel

Additionally, we reviewed our materiality in 2021 and identified "Mitigation and adaptation to climate change" as one of our priority issues. In 2023, we reviewed our materiality again.

Please see below for the process of identifying materiality and determining relative importance.

Risk management

The Group has established Risk Management Committee, chaired by the President and Member of the Board, which reports twice a year to Board of Directors and Executive Committee. Risk Management Committee manages significant company-wide risks, including climate change, from a short- to medium-term perspective and strives to prevent and avoid them. Sustainability Committee and the TCFD Subcommittee manage the risks and opportunities posed by climate change to our business from a medium- to long-term perspective under the Sustainability Promotion Structure. Based on the results of scenario analysis, we conduct a quantitative assessment of the financial impact of identified risks and opportunities and review countermeasures annually. The TCFD Subcommittee reports the results of discussions to Board of Directors and Executive Committee quarterly. Board of Directors provides necessary instructions or advice and monitors the situation. We will continue to expand and deepen the scope of our analysis, minimize risks, maximize opportunities, and initiatives our resilience.

For details on risk management related to sustainability in general, please refer to the "Risk Management" page.

Metrics and goals

We aim to reduce CO2 emissions by 50% compared to fiscal 2013 levels by fiscal 2030 (Scope 1, 2), and to achieve carbon neutrality by achieving zero emissions by fiscal 2050. We also aim to work with suppliers to reduce emissions throughout the entire supply chain (Scope 3), including CO2 emissions from purchased raw materials and product manufacturing. For Scope 3, we will work to improve the accuracy of calculations for Category 1 and Category 4 emissions, which have high emissions, and consider ways to reduce them.

We have introduced Internal Carbon Pricing (ICP) from April 2023. We aim to promote investment and investment decision-making to reduce CO2 emissions.

Main initiatives

- Reduction of energy consumption (process optimization, energy saving, introduction of high-efficiency equipment, etc.)

- Utilization of renewable energy (use of biomass fuel, etc.)