Executive compensation

Basic policy of executive remuneration system and our company's initiatives

Our executive remuneration system is designed to clarify the responsibility of executives for improving business performance and corporate value, and to increase their motivation and morale to do so.

Executive remuneration consists of fixed remuneration, bonuses as short-term incentive remuneration, and stock-based remuneration as long-term incentive remuneration. The purpose of the stock-based remuneration (long-term incentive) is to link the remuneration of Member of the Board, etc. with the Company's business performance and stock value, and to have Member of the Board, etc. share not only the benefits of rising stock prices but also the risks of falling stock prices with shareholders, thereby raising their awareness of contributing to improving medium- to long-term business performance and increasing corporate value.

In order to promote the enhancement of corporate value through non-financial information, we have incorporated ESG indicators into the commitment targets of our executives from fiscal 2022.

ESG indicators require employee engagement survey scores and set issues such as climate change, sustainable procurement, sustainable product development, and diversity, equity, and inclusion based on the characteristics of each department.

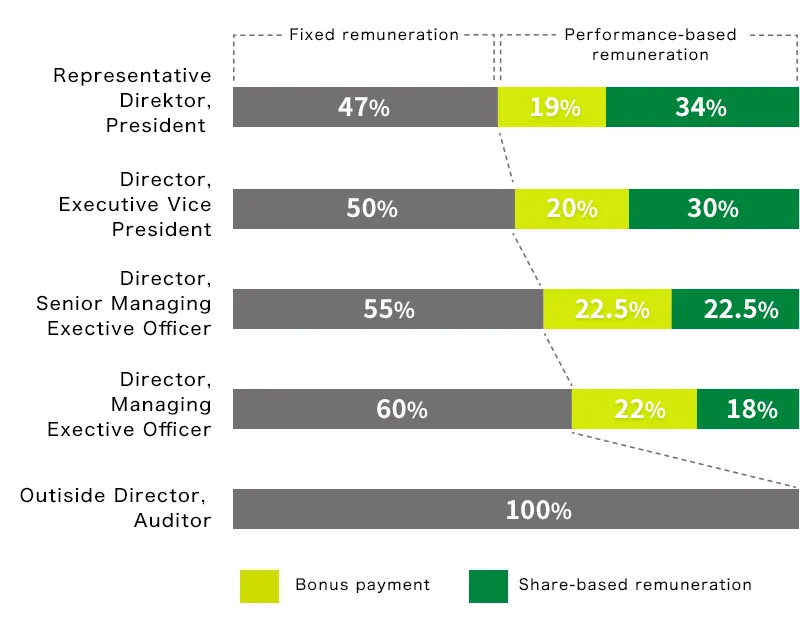

Composition of remuneration and payment targets

Executive compensation consists of fixed compensation and Performance-based remuneration.

Overview of executive remuneration system

| Fixed remuneration | Performance-based remuneration | ||

|---|---|---|---|

| Bonus (short-term incentive) | Stock compensation (long-term incentive) | ||

| Linkage with performance | Fixed | Linked to short-term performance | Linked to medium- and long-term performance |

| Performance evaluation period | - | 1 year | 6th year |

| Calculation method | The execution amount is set by position Member of the Board portion is set for Member of the Board 's responsibilities. The representative authority portion is set for the responsibilities regarding the representative authority. |

Standard amount by position based on consolidated operating income budget at the beginning of the year × (Relative to the operating income budget at the beginning of the year) Company-wide performance target achievement rate ×Distribution by position *1 + Commitment goal *2 Achievement rate × Distribution by position *1) |

Points awarded by position × Achievement rate for each index each year <Indicators> Consolidated operating income, ROIC, ROE, EPS |

| Performance-linked range | - | 0~200% | 0~200% |

| Payment period | Monthly | Once a year | Upon retirement of each officer |

| Payment method | Cash | Cash (There is a clause for reducing the amount in the event of a scandal, etc.) *3) |

70% stocks, 30% cash (Subject to Mars clawback clause *4) |

(Updated in July 2025)

*1 The company-wide performance target is set by the representative Member of the Board 80% Member of the Board concurrently Executive Officer 70%, and the commitment target is set by the representative Member of the Board 20% Member of the Board concurrently Executive Officer 30%.

*2 Of the initiatives that the company will focus on, especially those committed by the executive officers themselves. initiatives

*3 In the event of quality problems, serious accidents or scandals, the amount paid may be reduced.

*4 The amount will not be reduced or paid in the event of any irregularity, etc. during the term of office, and in the event of the occurrence of any of the stipulated matters even after receiving the benefits or delegation, the company may demand the return of the equivalent amount of shares or cash that has been paid.

Compensation composition ratio by payment target

Determination of compensation

Determination of executive compensation

In order to clarify the independence, objectivity, and accountability of Board of Directors' functions, executive compensation is determined by Board of Directors following deliberation by Compensation Advisory Committee.

Compensation Advisory Committee is chaired by an independent Member of the Board(Outside Director) and is composed of a majority of outside directors. In fiscal 2024, it met a total of six times to mainly deliberate on the compensation system (short-term and long-term incentives) and the committee's activity plan for fiscal 2024.

FY2024: Total amount of remuneration by officer category, total amount by type and number of officers

| Officer classification | Total amount of remuneration, etc. (million yen) |

Total amount of compensation by type (million yen) | Subject to number of officers (peasons) |

||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-based remuneration | ||||

| Bonus (Monetary compensation) |

Stock compensation (Non-monetary compensation, etc.) |

||||

| Member of the Board (excluding Member of the Board (Outside Director) | 238 | 104 | 41 | 92 | 3 |

| Audit and Supervisory Board Member (excluding Outside Audit and Supervisory Board Member) | 35 | 35 | ― | ― | 3 |

| Outside officer | 67 | 67 | ― | ― | 8 |

(Note 1) The amount of stock compensation is the amount recorded as an expense during the current fiscal year for the Stock Benefit Trust (BBT).

(Note 2) The amount of bonus is the amount to be paid.

(Note 3) The three Member of the Board (outside Directo), including one Member of the Board (Outside Director) who retired at the conclution of the 24st Ordinary The General Meeting of Stockholders held on June 24, 2024 are not included as they do not receive compensation.